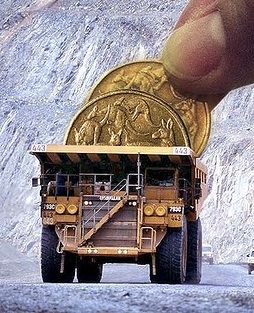

BHP's big squeeze to see better numbers

BHP Billiton is putting pressure on its suppliers to take cuts of up to 25 per cent so the major miner can save some money, and analysts say others will follow.

BHP Billiton is putting pressure on its suppliers to take cuts of up to 25 per cent so the major miner can save some money, and analysts say others will follow.

BHP Billiton announced a plan this week to cut $4.5 billion from its annual operating spend by 2017.

In its profound economic wisdom, BHP is looking to save money by paying less.

The mining giant hopes to make savings by paying its suppliers less, framing the move as a focus on lowering contract rates for goods and services.

Analysts including Bell Potter Securities’ Giuliano Sala Tenna say continually dropping iron ore prices have forced BHP to put the squeeze on its suppliers.

“The market is still very over-serviced, we need to see more competition coming out of the market,” he told the ABC.

“The big miners, whether it's iron ore or coal, are all looking at reducing costs, and a big part of their costs is their service providers.

“Clearly when a company like a BHP comes out and says these sorts of statements, it gives other providers, perhaps smaller miners, the confidence to also toe the line and really be aggressive with their negotiations with some of their service providers.

“We're going to see a lot of work done at just above cost to keep some of them going.”

Macquarie Private Wealth analyst Bevan Sturgess-Smith said some companies were less stringent on their costs during boom-times.

“Their revenues were once growing at 50, 60, 70 per cent per annum,” he said.

“The internal management of finances or the focus on costs might not have been as strong within some companies, so when those revenues drop, they've got the high level of cost and just can't exist.

“Miners are now making cutbacks to lower their costs ... so they're passing that responsibility onto the contractor to provide the services at a better price.

“The costs involved in the project are lower, certainly labour costs are lower, not much lower, but the costs of raw materials and things like that, are definitely lower.”

Some observers predict companies will fall out of the market, while others may be forced to merge to stay afloat.

Print

Print